inheritance tax rate indiana

Indiana does not have an inheritance tax nor does it have a gift tax. While it typically gets a bad rap probate was added into Indiana inheritance laws to protect the last wishes of a decedent whether he or she had a testate will or not.

When Are Life Insurance Proceeds Taxable Valuepenguin

Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax.

. Married couples can avoid taxes as long as the estate is valued at under 2412 million. Estate tax rates vary from state to state. For more information check our list of inheritance tax forms.

NET TAXABLE VALUE OF PROPERTY INTERESTS TRANSFERRED INHERITANCE TAX 100000 or less 7 of net taxable value over 100000 but not over 500000 7000 plus 10 of net. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax. There is no inheritance tax in Indiana either.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Inheritance tax usually applies when. Class C beneficiaries had only a 100 exemption and the tax rates ranged from 10 to a 20.

Do you have to pay taxes on inherited money in Indiana. Additionally the new higher exemption means that theres room for them to give away another 720000 in 2022. The Iowa tax only applies to inheritances resulting from estates worth more than 25000.

However many states realize that citizens can avoid these taxes by simply moving to another state. As of 2018 an individual can give another person up to 15000 per year as a gift tax-free. 10 of the unpaid tax liability or 5 whichever is greater.

In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of Checking Account Form IH-19 are required for those dying after Dec. Up to 25 cash back Each beneficiary except those who are entirely exempt from the tax must pay tax on the amount he or she inherited minus the exempt amount. Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess.

This penalty is also imposed on payments which are required to be remitted electronically but are not. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a. The 1917 amendment provided that gifts made.

For example a lucky grandchild who inherits 150000 would owe tax on 50000 because for Class A beneficiaries no tax is due on the first 100000 inherited. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. Failure to pay tax.

There is also a tax called the inheritance tax. However the inheritance tax was an issue for those transferring large amounts of capital wealth to heirs and for transfer to unrelated parties known as Class C beneficiaries. 45 percent on transfers to direct descendants and lineal heirs.

The act was amended in 1915 1917and 1919. Trusts and Estate Tax Rates of 2022. Indiana Department of Revenue Re.

In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Tax rates can change from one year to the next. Inheritance Tax Division PO.

The Probate Process In Indiana Inheritance Law. Inheritance tax applies to assets after they are passed on to a persons heirs. Indiana Inheritance and Gift Tax.

For example Indiana once had an inheritance tax but it was removed from state law in 2013. Box 71 Indianapolis IN 46206-0071. State inheritance tax rates range from 1 up to 16.

Any more than that in a year and you might. The decedents surviving spouse pays no inheritance tax due to an unlimited marital deduction. The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers.

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing address. C The inheritance tax imposed on a decedents transfer of property interests to a particular Class B transferee is prescribed in the following table. However other states inheritance laws may apply to you if someone.

Property owned jointly between spouses is exempt from inheritance tax. Rates and tax laws can change from one year to the next. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021.

In Maryland the tax is only levied if the estates total value is more than 30000. Fraudulent intent to evade tax. Heres a breakdown of each states inheritance tax rate ranges.

Find more information on Inheritance Tax FAQs. Failure to file a tax return. Failure to file a tax return.

In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. States have typically thought of these taxes as a way to increase their revenues. People who receive an inheritance might have to pay taxes on it but the giver has to pay gift taxes.

No tax has to be paid. The lowest rate is. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent.

For most decedents estates there was no or very little Indiana inheritance tax.

Sw Indiana Megasite Southwest Indiana Megasite

I Just Inherited Money Do I Have To Pay Taxes On It

Annuity Beneficiaries Inheriting An Annuity After Death

Democrats Target Grantor Trusts The Rich Use To Pass On Fortune Tax Free Bloomberg

Cook County Il Property Tax Calculator Smartasset

Dor Requesting An Extension Of Time To File Via Intime

Cook County Il Property Tax Calculator Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Annuity Beneficiaries Inheriting An Annuity After Death

Integra Kentucky Southern Indiana

Sw Indiana Megasite Southwest Indiana Megasite

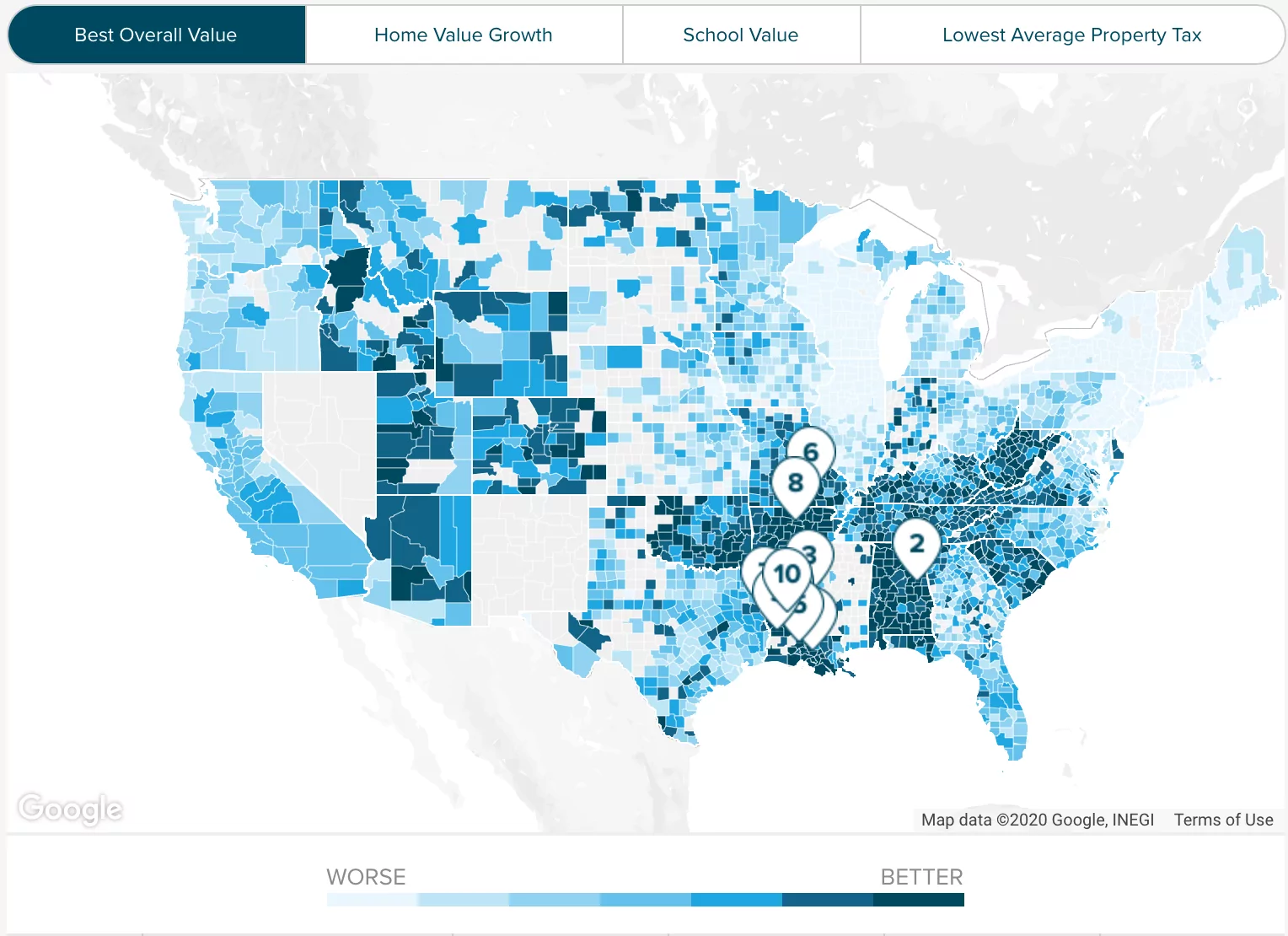

24 States That Don T Tax Retirement Income

Dor Requesting An Extension Of Time To File Via Intime

Oklahoma State Taxes 2022 Forbes Advisor Forbes Advisor